The US formally suspended tariffs rises on £200bn of Chinese goods but hopes of resolving a trade war between the two nations faded, sending global stock markets fell for the third straight day on Thursday.

US Trade Representative (USTR) Robert Lighthizer pushed back higher import duties which had been due to come in on Friday “until further notice”.

A costly trade war between the two nations and fears about the rise of protectionism around the world has been casting a shadow over the world economy for months.

Mr. Lighthizer warned that Washington will need to maintain the threat of imposing tariffs on Chinese goods for years even if a deal is reached.

“The reality is this is a challenge that will go on for a long, long time,” he said.

He warned that promises from Beijing to purchase more US goods must include a way to ensure they are met.

Washington will need to maintain the threat of imposing tariffs on Chinese goods for years even if a deal is reached, he said, adding: “The reality is this is a challenge that will go on for a long, long time.”

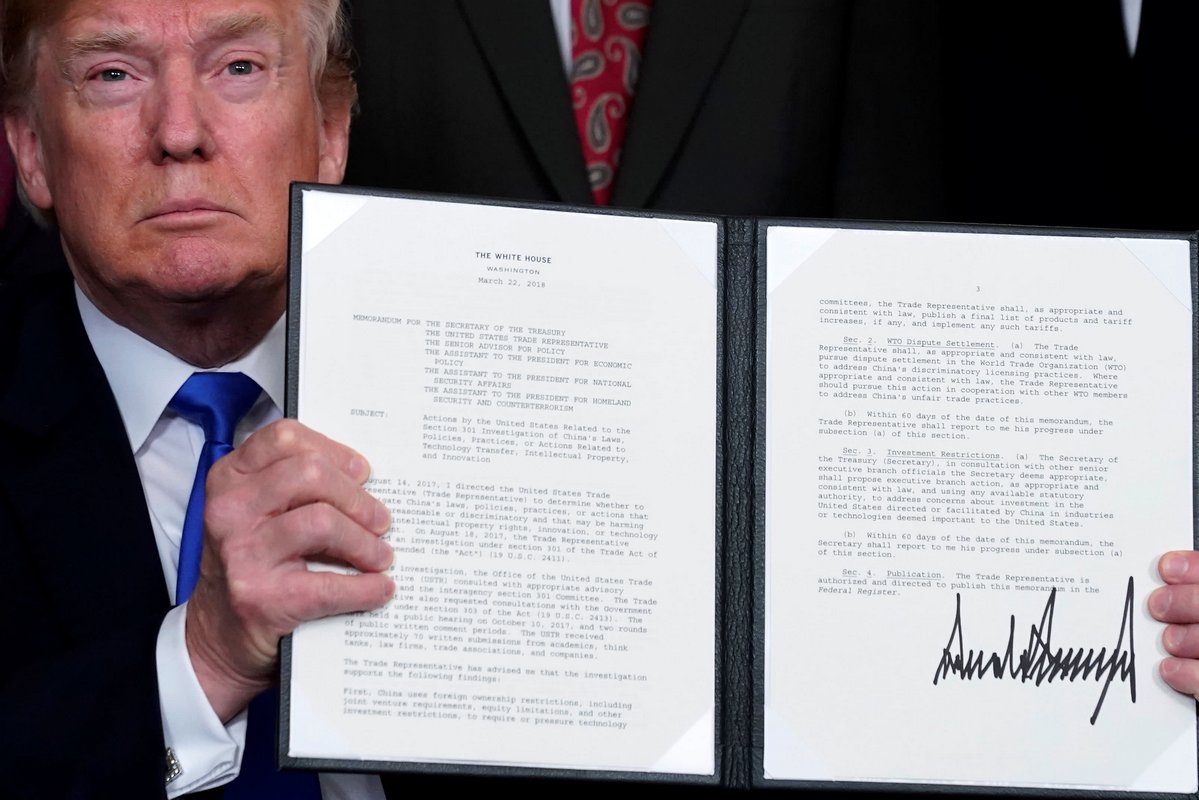

“In accordance with the president’s direction, the Office of the United States Trade Representative will publish a notice in the Federal Register this week to suspend the scheduled tariff increase until further notice,” the USTR said.

An early end to a summit between Mr. Trump and North Korean leader Kim Jong Un this week also dented confidence in the future of the global economy.

The FTSE 100 fell 0.6 percent and the pan-European Stoxx 600 was down 0.4 percent while the Japanese yen and Swiss franc – both safe-haven currencies – gained.

Oil prices fell on Thursday amid weakening factory output in China and Japan and record US crude output.

Alghadeer TV Alghadeer TV

Alghadeer TV Alghadeer TV